Change My Direct Deposit For Unemployment Va

change unemployment wallpaperDirect Deposit is an option offered to you for your convenience. Change your direct deposit and contact information for certain VA benefits.

Get Your Stimulus Check By Direct Deposit H R Block

Call the DUA direct deposit line at 617 626-6570.

Change my direct deposit for unemployment va. This telephone line is open from 730 am. Complete this form to select or change your Unemployment Insurance benefits payment method. If you wish to.

To update your Direct Deposit information please do one of the following. Reopen an existing claim after a break has occurred in your weekly request for payments. Claimants can file for unemployment insurance by calling 1-866-832-2363 between.

Select the Direct deposit button and click Submit. For example if your state pays weekly youll need to get certified each week to verify that you are still eligible for benefits When it comes to unemployment payment methods most states allow you to either set up a direct deposit to your bank account or receive a prepaid debit card specifically for your unemployment benefits. Log in to your UI Online account.

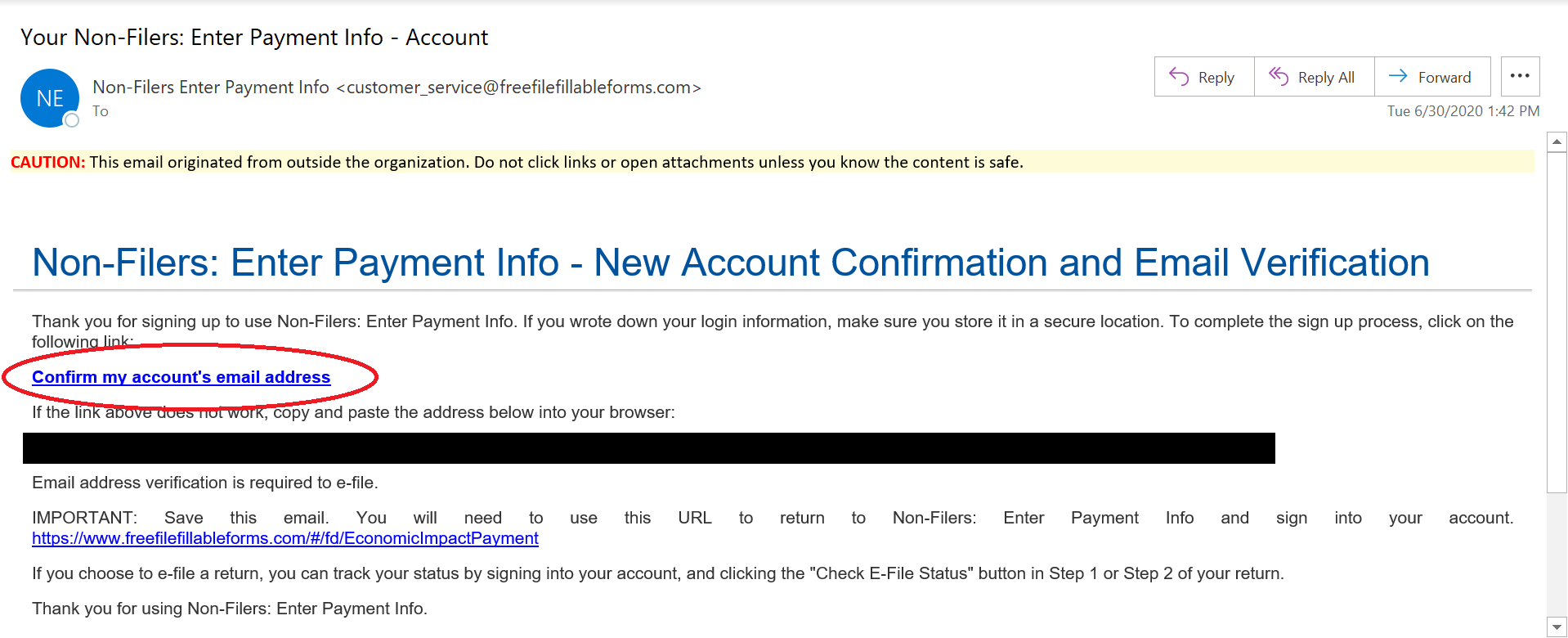

Beware of fraudulent unemployment websites. Select Payment method options and click Edit. To change your direct deposit information by telephone calling 1-877-838-2778.

Central Time Monday through Friday. Scroll down and select the Update Direct Deposit button and choose if you are the owner or co-owner of the bank account. If you do not have a direct deposit account you will be issued a debit card to access your benefits but you may switch to direct deposit.

Choose which language you would like to listen to the instructions in. And you will receive any benefit payments made during this time by check. 711 or Call us at 918-781-7550 for international direct deposit updates or Go to your nearest VA regional office and change this information in person.

Sign in and Select the blue Benefits Payment Details link on the right side of the screen. Direct Deposit and Contact Information Update Update your payment and contact information for your VA compensation and pension benefits and payment information for education benefits. Enter your Social Security number.

Select option 1 to enter in your direct deposit information. It will not speed up the actual payment of your benefits. Select View and maintain account information in the left pane.

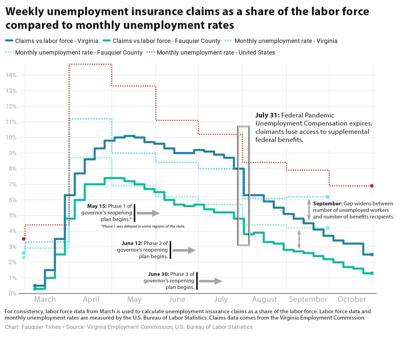

Change your VA direct deposit and contact information. The VEC plans to enroll all unemployment recipients in one of the electronic payment methods within the next two to three months. Over 6000 claimants have already enrolled in the direct deposit or debit payment card option.

Enter your bank account information and select Next. Call us at 800-827-1000 TTY. Keeping your contact and direct deposit information up-to-date will prevent unnecessary interruptions in communications and payments from VA.

Your deposit normally will be in your account 24 to 48 business hours after payment is authorized. File a partial claim. This verification will take approximately.

Use VA Form 10-10EZR to update your personal financial and insurance information after youre enrolled in VA health care. On the main menu page once you have logged in click the link to the left that says Direct Deposit Enrollment Form or Change of Address depending on what you need to do. Access your life insurance policy online.

Both procedures can be completed online. Always ensure you are on our site when filing for benefits changing your personal info or signing up for direct. How to changeChange direct deposit information for your unemployment benefits.

File a new claim for unemployment benefits. Once direct deposit begins payments will be directly deposited to the account you provided for the duration of your claim and generally from claim to claim until you change your direct deposit. Review and verify your banking information and select Submit then select Done.

To update your direct deposit information or the address on your paper checks you can. The reported change will be verified with your bank or credit union. File your continued weekly claim for benefits.

A new Agreement for Direct Deposit. Call us at 1-888 GI BILL 1 1-888-442-4551. Your direct deposit you must complete a Cancellation of Direct Deposit ESA-1126A.