Gi Bill Scholarships And Grants

bill scholarshipsWhat many Post 911 GI Bill users dont know is the VA is the last payer when using multiple financial aid tuition-dedicated programs. Scholarships Grants Specifically for Family Members of Servicemembers Many dependents children and spouses are fortunate enough to have received Post 911 GI Bill entitlement from a parent through a Transfer of Education Benefits TEB.

Each year thousands of financial aid dollars go unawarded and are turned back to their sponsors due to a lack of applicants.

Gi bill scholarships and grants. Scholarships for veterans can include specific scholarships for military veterans active duty members of the armed services and also children and spouses of veterans. That leaves an unpaid balance of 25000. Any additional fenced tuition and fees only scholarships would be applied before Yellow Ribbon or GI Bill funds.

The programs are paid by the US. These fenced scholarships would further reduce the total out-of-pocket expenses. 36 months of full tuition and fees at public universities and colleges.

YRP recipients must remain in good academic standing while receiving the award. This version of the GI Bill offers more benefits to service members including. GI Bill Pell Grant and ScholarshipsGrants If you received a Pell grant you wont include the grant amount in your federal taxable income unless you used the funds for unapproved purposes.

For in-state students all tuition and fees 12763year are covered by the Post-911 GI Bill. 1 2013 and using the Post-911 GI Bill have 15 years from their discharge to use all their GI Bill. UCLA is a public university.

If your tuition is paid through your scholarship then the VA will not pay anything for your tuition as they are the last bill payer and there wont be anything left to pay. But wait your school had offered you a 19000 scholarship early in the application and funding process which should have reduced your remaining unpaid balance to 6000. Those discharged prior to Jan.

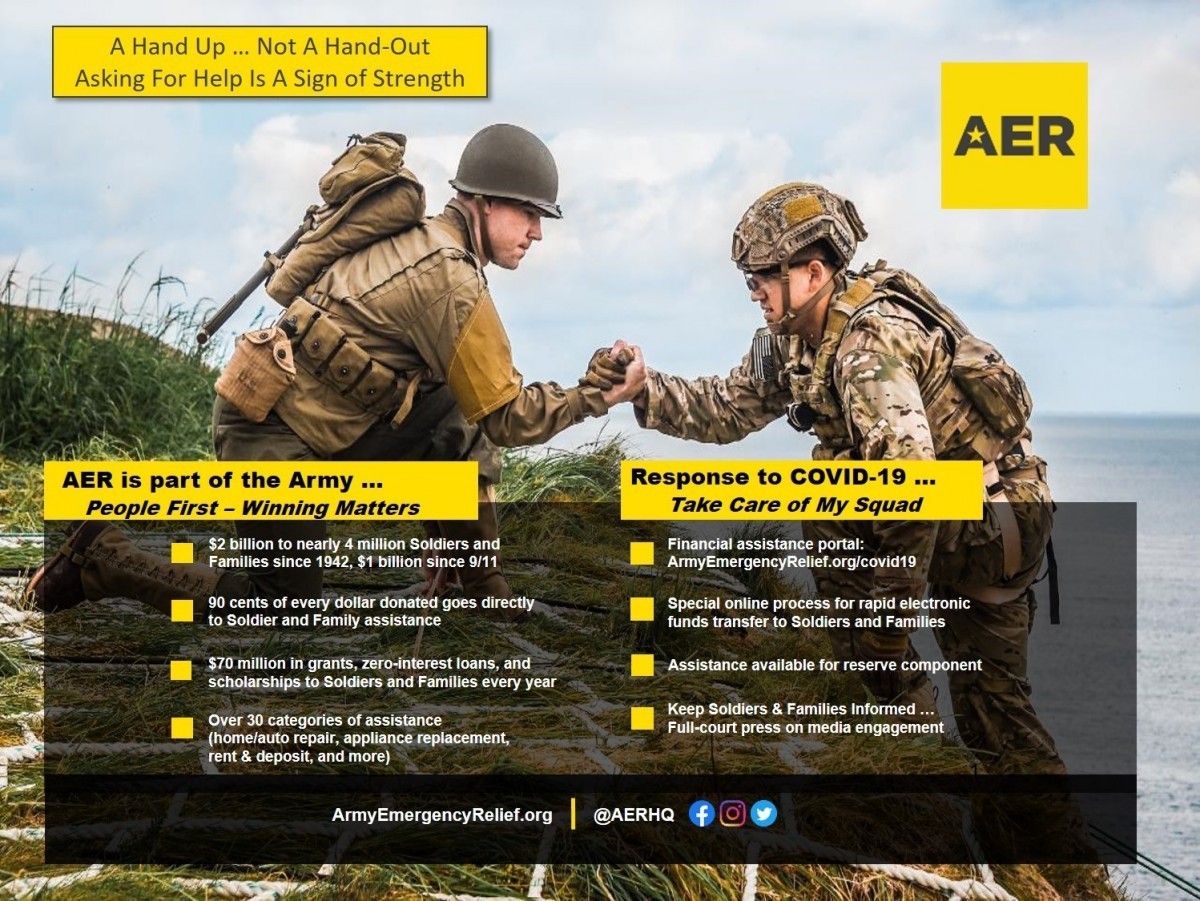

Before discussing military scholarships along with grants that veterans their spouses and children can use it is worth discussing the Post-911 GI Bill. This award is a supplement to Post-911 GI Bill. Department of Veterans Affairs provides service members who served after September 10 2001 with considerable benefits.

We know that at the 100 tier level the Post 911 GI Bill would pay 2516214 per year in tuition and fees. Because the scholarship pays all of the tuition the VA pays nothing toward it. Your other options include scholarships veterans discounts state.

Types of aid available include flexible payment plans reduced tuition rates grants student loans and veteran college scholarships i. In general exceptions apply Pell Grants are normally offered to. You might be surprised to know that the GI Bill is only one of hundreds of programs to help veterans afford a college degree.

So if you have various scholarships and grants that are tuition fenced meaning the money must be applied towards tuition then the VA would only be responsible to pay what tuition difference is left and. The YRP scholarship including the VA match combined with Brandeis grants and scholarships federal aid and other estimated financial assistance cannot exceed the cost of attendance and Brandeis gift aid may be adjusted. The Post-9-11 GI Bill provides educational resources for individuals who served on active duty after September 10 2001 with at least 90 days of aggregate service or individuals who were discharged as a result of a service-connected disability after serving 30 continuous days following September 10 2001.

Generally for the Pell grant to retain its tax-free status you must be a degree candidate at the college and only use the funds to pay for tuition fees books supplies and equipment. Even if the cost of your tuition is fully covered by Tuition Assistance or TA plus the GI Bills top up program you can still qualify for scholarships and grants to assist with books fees and living expenses. Veterans may also qualify for other benefits from the federal government such as the GI Bill.

Recipients will be eligible to receive. The federal government offers several financial aid programs that can be used in conjunction with GI Bill benefits. So all you are getting out of your GI Bill entitlement is the book stipend paid at 4167 per credit and your housing stipend.

Students are able to double-dip because the GI Bill does not fall under the category of federal financial aid. It not only covers the benefits of the Post 911 GI Bill and other federal programs but also scholarships and grants that can supplement GI Bill benefits. FAFSA is not required for those only using their GI Bill funds though your college may request you complete one regardless.

Any scholarships received would be deducted from the tuition first and. Under this bill the US. Undergraduate students who display exceptional financial need AND Have not earned a bachelors graduate or professional degree.

Financial Student Aid Programs offer low interest loans and grants to help to supplement education costs not covered by GI Bill benefits. The same student with the same scholarship but using the Post 911 GI Bill could get a housing allowance of 1300 per month and a 500 book stipend for a balance of 5200 after taking out the 500 for books. If you find yourself in need of additional student aid you can begin applying for grants scholarships and student loans on top of your GI Bill benefits.

Fact 2 - The GI Bill Is Not Federal Financial Aid. Department of Education through the school and are designed to assist with tuition books fees and.