Montgomery County Tax Bill Texas

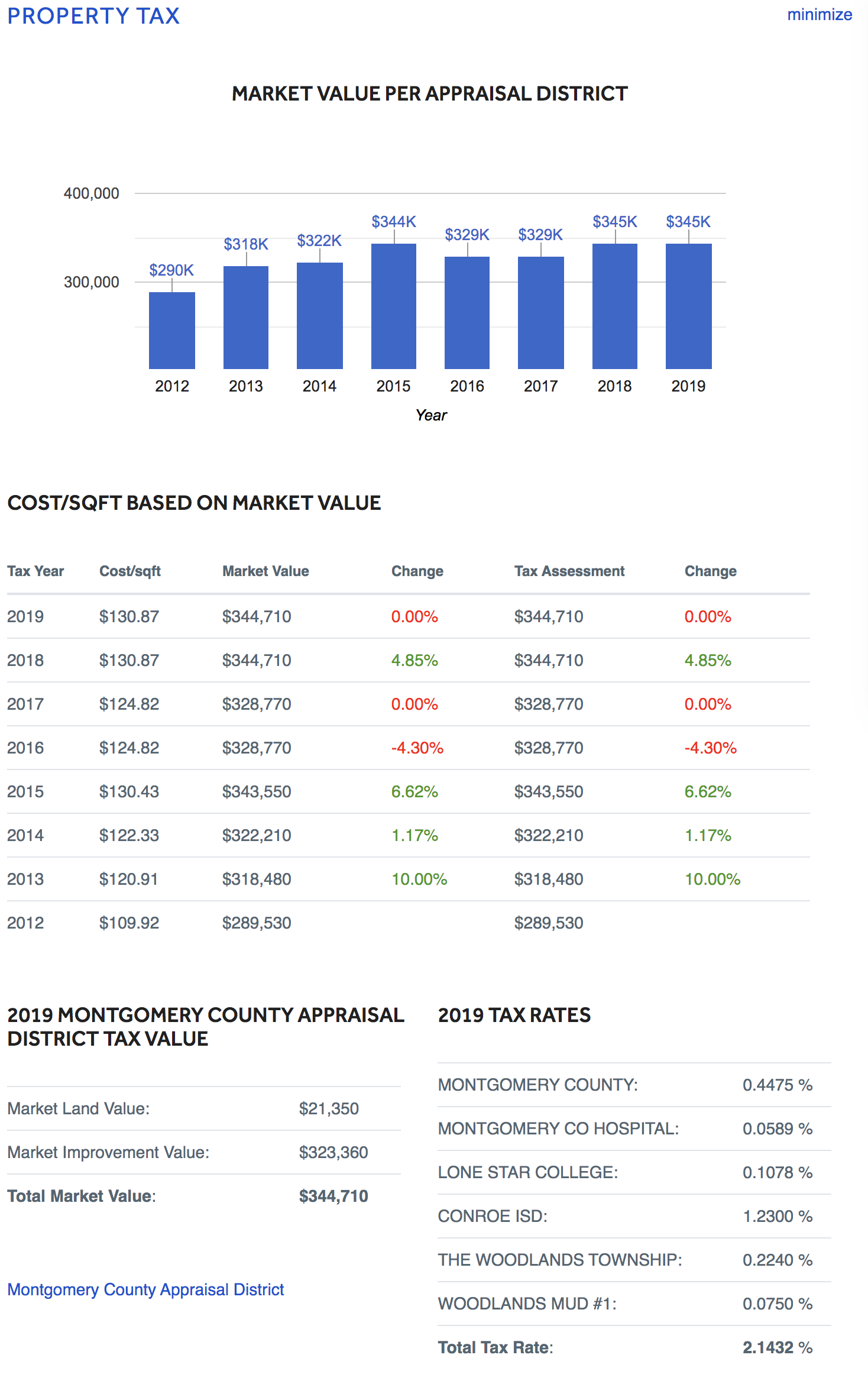

county texas wallpaperThe certified tax roll and the tax rates adopted by each taxing jurisdiction are used to levy the current property taxes in October of each year. Facebook Feed Montgomery County Hospital District.

Frequently Asked Questions In Divorce Cases In Harris And Montgomery Counties Texas Divorce Case This Or That Questions Divorce

For information regarding tax rates and tax bills contact the Montgomery County Tax Office Question 1.

Montgomery county tax bill texas. The Tax Office its officers agents employees and representatives shall not be liable for the information posted on the Tax Office Website in connection with any actions losses damages claims or liability in any way related to use of. The Montgomery County Tax Office makes no representations as to the accuracy or reliability of any information accessed from its computer data base. Non-fee License Plates such as Purple Heart and Disabled Veterans License Plates.

Occupations Tax Permit Replacement Form. Montgomery County MUD 8 has a Property Tax Rate in 2020 of 02968 per 100 of assessed value of the property. Affidavit of Motor.

The Montgomery County Tax Office receives the certified tax roll from the Montgomery Central Appraisal District usually in July then the property values are loaded on the Tax Office Computer System. County tax assessor-collector offices provide most vehicle title and registration services including. Select your Tax Office Ad Valorem Harris County MUD 109 Harris County MUD 36 Harris County MUD 386 Alief ISD Tax Office Burkburnett ISD Tax Office Cape Royale Utility District Carrollton-Farmers Branch ISD Tax Office City Of Eagle Pass City of Garland Tax Office City Of Sulphur Springs Clear Creek ISD.

Registration Renewals License Plates and Registration Stickers Vehicle Title Transfers. A basic capitalization rate of 100 will be. Motor Vehicle Titles and Registration Forms.

4001 10000 gallons225 per 1000 gallons. Rent restricted properties vary widely. For information regarding property values exemptions protests etc contact the Montgomery Central Appraisal District.

Montgomery County Commissioners Court. Disabled Parking Placards. Full Rate Order PDF a The water usage rates are a tiered structure to encourage water conservation.

The office also collects property taxes for 69 of 77 other taxing jurisdictions. Application For Occupations Tax Permit. Change of Address on Motor Vehicle Records.

Alcoholic Beverage License And Permits. 111825r of the Texas Property Tax Code The Montgomery County Appraisal District gives public notice of the capitalization rate to be used for the 2021 Tax Year to value properties receiving exemptions under this section. 113 MUD 113 is a political subdivision of the State of Texas operating pursuant to Article XVI Section 59 of the Texas Constitution and Chapter 8212 of the Texas Special District Local Laws Code.

In addition on behalf of the County and other governing bodies the Tax. The tax rate will effectively be raised by 389 and will not raise taxes for maintenance and operations on a 100000 home. The archive of todays meeting will be up this afternoon in full.

Click here for CDC Updates. Conroe Texas 77301 936 539 - 7897. The certified tax roll and the tax rates adopted by each taxing jurisdiction are used to levy the current property taxes in October of each year.

And ad valorem tax rate for the 2017 tax year is 030 per 100 of valuation. Montgomery County Municipal Utility District No. Montgomery County Tax Office.

The county is providing this table of property tax rate information as a service to the residents of the county. Property Tax Bills Tax Code Section 3101 requires the assessor to prepare and mail a tax bill to each property owner listed on the tax roll or to that persons agent by Oct. Please visit their respective websites for additional information.

These variations can have an effect on the valuation of the property. The Tax Assessor-Collector elected by registered voters of Montgomery County for a four-year term holds the Constitutional Office charged with duties and responsibilities mandated by State Statutes to assess and collect ad valorem tax accounts as identified and valued by the Montgomery Central Appraisal District. Vessel.

46 - The Woodlands Water Agency 281-367-1271. Click the image below to see a detailed PDF explaining the information on the tax statement. Click here for.

Montgomery County MUD No. State of Texas Property Tax Code. The Montgomery County Tax Office receives the certified tax roll from the Montgomery Central Appraisal District usually in July then the property values are loaded on the Tax Office Computer System.

1 or as soon thereafter as practicable each year. The Montgomery County Tax Office also collects beer wine and liquor licensing fees and occupational taxes relating to vending machine permits. The Montgomery County Tax Office does not host TxDMV Motor Vehicle Title and Registration and Texas Parks Wildlife related forms.

The central management agency for the eleven Municipal Utility Districts MUDs that currently serve The Woodlands in Montgomery County. 2020 Taxes Payment Deadline. No w offers live video streaming.

You can also see the Tax System Basics references at the Texas Comptroller of Public Accounts website. December 15 2020 Governor Abbott Lifts Temporary Waiver of Vehicle. Boat.

Click here to watch now. State of Texas Property Tax Code. Texas Parks Wildlife.

Montgomery County Tax Office 400 N. Truth in Taxation Summary Texas Property Tax Code Section 2616. The District has the authority to purchase construct operate and maintain all works improvements facilities and plants necessary for.

Each individual taxing unit is responsible for calculating the property tax rates listed in this table pertaining to that taxing. Acting as an Agent for the Texas Department of Motor Vehicles TxDMV all vehicle and trailer registration and titles are processed in this office for residents of the county. We apologize for the issues experienced this morning.

Https Www Montgomerycountytax Org Wp Content Uploads 2018 05 2015 Property Tax Statements In The Mail Pdf

Lowest Property Taxes In Texas By County In 2019 Tax Ease

Montgomery County Property Tax Due Date Extended Wdtn Com

Montgomery County Property Tax Records Montgomery County Property Taxes Tx

Montgomery County Tax Office S Budget Highlights Mailed With Tax Statements Misleading The Golden Hammer

Montgomery County Appraisal District How To Protest Property Taxes

Protest Property Tax In Montgomery County Mcad Property Tax Reduction

Montgomery County Commissioners Propose 1 4 Property Tax Rate Decrease For Fy 2020 21 Community Impact Newspaper

Montgomery County Property Tax Appeal Republic Property Tax

New Construction Neighborhoods With Low Taxes In Montgomery County Har Com

New Caney Branch Office Montgomery County Tax Office Official Site

Montgomery County Md Property Tax Calculator Smartasset

Montgomery County Tax Office Grants Four Month Extension On Property Tax Payment Agreements Community Impact Newspaper

Tax Assessor Collector Montgomery County

Montgomery County Moves Forward With Property Tax Increase Below The Voter Approval Rate The Texan

Patton Village Texas Wikipedia