How Much Is Pension Contribution In Ireland

contribution much pension wallpaperJim is 42 and earns 50000 per annum from employment. This pension is taxable but you are unlikely to pay tax if it is your only income.

Https Web Actuaries Ie Sites Default Files Story How Much Do You Need To Save For A Pension 060517savingforpensions Pdf

As of January 2016.

How much is pension contribution in ireland. For example an employee who is aged 42 and earns 40000 can get tax relief on annual pension contributions up to 10000. If you currently have a pension fund please enter the value of that pension fund in the field shown. The maximum rate of State pension contributory is 24830 regardless of whether you have been assessed using the Yearly Average Method or the Aggregated Contribution Method.

Qualifying age for State pensions. Under the finance Act 2012 the age at which people qualify for the state pension will increase over time to 66 years of age in 2014 67 in 2021 and 68 in 2028. You must have paid at least 520 full rate social insurance contributions and have a yearly average of at least 48 paid andor credited full rate contributions from the year you started insurable employment until you reach 66 years of age.

The state pension Contributory for a single person is 12132 pa. Contributions to an employees Personal Retirement Savings Account PRSA are a benefit in kind. Revenue have set a limit for determining maximum net relevant earnings for pension purposes at 115000 for 2019.

If you have worked in Ireland and also in one or more EU states your social insurance contributions from each EU state will be added to your Irish PRSI contributions to help you to qualify for a social welfare payment such as a State pension. You can use any social insurance PRSI contributions you may have paid in a country covered by EC Regulations or a country with which Ireland has a bilateral Social Security Agreement to satisfy the 520 260 paid contributions requirement for a pro rata pension a proportionate pension. Pension contributions Employer contributions to an approved occupational pension scheme OPS on behalf of employees are a not a benefit in kind in their hands.

Every contribution you make to a pension plan receives tax relief based on the rate of income tax you pay most of us pay income tax at a rate of either 20 or 40. His maximum individual pension contribution is 25 of 50000 or 12500. Contributions made in excess of these limits may not receive tax relief.

The table below illustrates the maximum pension contribution for individuals as a percentage of Net Relevant Earnings. Learn how pensions are taxed in Ireland and how much you may pay on your plan. Total earnings limit The maximum amount of earnings taken into account for calculating tax relief is 115000 per year.

After working hard for most of your life when you reach retirement wouldnt it be nice to have the money you need to maintain your standard of living in retirement. The means-tested State Pension Non-Contributory is a payment for people aged over 66 who do not qualify for a State Pension Contributory or who only qualify for a reduced contributory pension based on their insurance record. If you dont have the above then you must.

These Figures are estimates only. The SPNC is financed through general taxation and is paid according to need. If you have a defined contribution DC pension theres no such link or guarantee it will depend on how much you paid in and on how the investments performed.

However the benefit is taxable only where the aggregate of employers and employees PRSA contributions exceed the employees. From March 2019 the State pension in Ireland for a person aged 66 or over is 24830 per week. The contribution base rate is currently 1475 percent with 1075 percent paid by employers and 4 percent by employees except for employees who earn less than EUR 352 per week for whom only employer contributions are payable.

To qualify for the State pension you must have started paying social insurance before reaching 56 years of age.

Can I Transfer My Australian Pension Back To Ireland

Irish Public Pension System Expenditure Trends And Recipient Numbers Public Policy

Pension Auto Enrolment Looks Unlikely In 2022

Ireland S Pensions All Set For Big Changes Country Report Ipe

What Happens If You Have Too Much Money In Your Pension Fund

Does Your Pension Fund Need Some Rocket Fuel

New Survey Discovers Almost Half Of Irish Workers Do Not Have A Pension

Pension Coverage 2018 Cso Central Statistics Office

Confused By What Pension My Prsi Contributions Will Get Me

Help I Ve No Prsi Stamps Can I Still Get A Pension

Irish Payroll And Tax Information And Resources Activpayroll

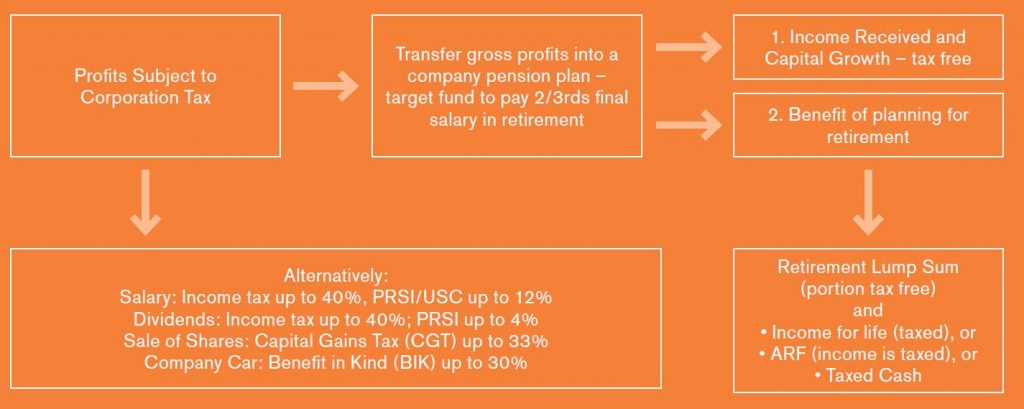

Taking Your Profits How Pension Contributions Work

How Can I Claim My Irish State Pension From Abroad

What Are The Retirement Ages In Ireland Early Retirement

![]()

Executive Pension Plan A Guide Icon Accounting Accountancy Services For Contractors

Details Announced Of Auto Enrolment Pension System Newstalk