Nigeria Imf Loan Conditions

conditions loan nigeriaHowever poorly executed Nigeria pursued economic reforms in the mid-1980s and decided not to take an IMF loan. The IMF however insisted that the Federal.

Nigeria Request For Purchase Under The Rapid Financing Instrument Press Release Staff Report And Statement By The Executive Director For Nigeria Nigeria Request For Purchase Under The Rapid Financing Instrument Press

Nigeria Request For Purchase Under The Rapid Financing Instrument Press Release Staff Report And Statement By The Executive Director For Nigeria Nigeria Request For Purchase Under The Rapid Financing Instrument Press

In a report published on Monday on the Article IV Consultation for 2020 which ended on January 27 the Board noted.

Nigeria imf loan conditions. The staff of the International Monetary Fund will recommend the approval of 34 billion in emergency funding to Nigeria when the lenders executive board meets next week according to two people. This system of conditionality is designed to promote national ownership of strong and effective policies. Three decades later Nigeria is much more unwilling to initiate reforms.

The IMF charges a lending rate annual commitment fees and service charge. Despite Loans Nigerias Socio-Economic Conditions Deteriorated IMF - Politics 2 - Nairaland. WILL THERE BE INTEREST ON REPAYMENT.

The board of the IMF had on Tuesday approved Nigerias request for 34 billion emergency support to address the severe impact of the COVID-19. IMF if you so please you can give Nigeria 350 trillion. The IMF has approved its largest COVID-19 emergency financing package so far a US34 billion Rapid Financing Instrument RFI for Nigeria.

I can assure you there will still be no tangible infrastructure and stable economy to show for it. The country has been hit hard by the coronavirus particularly because of the associated plunge in the price of oilNigerias top export commodity. In a brief official response to PREMIUM TIMES enquiry through another official of the Fund in Nigeria Laraba Bonet the IMF Representative confirmed the funding to be a loan and mentioned the two.

According to data from the website of the IMF the interest charged is not flat and applies to several factors. International Monetary Fund IMF has concluded that despite the 35 billion loan it gave Nigeria to cushion the effects of COVID-19 pandemic in April 2020 socio-economic conditions have worsened. As a member of the IMF Nigeria has to hold reserves with the fund.

On Nigerias rising debt levels Adrian said that the IMF was not overly concerned as it would allow the country to invest more in developing critical infrastructure. International Monetary Fund IMF has concluded that despite the 35 billion loan it gave Nigeria to cushion the effects of COVID-19 pandemic in April 2020 socio-economic conditions have worsened. International Monetary Fund IMF has concluded that despite the 35 billion loan it gave Nigeria to cushion the effects of COVID-19 pandemic in April 2020 socio-economic conditions have worsened.

Despite Loans Nigerias Socio-Economic Conditions Deteriorated IMF - International Monetary Fund IMF has concluded that despite the 35 billion loan it gave Nigeria to cushion the effects of COVID-19 pandemic in April. The IMF loan comes with a concessionary interest rate and is expected to be paid back by Nigeria. When a country borrows from the IMF its government agrees to adjust its economic policies to overcome the problems that led it to seek financial aid.

Nigerias 34billion IMF loan comes with many charges fees surcharges and interest of between two to three percent per annum and further devalues the Naira to N389976USD as against CBNs N360USD. In a report published on Monday on the Article IV Consultation for 2020 which ended on January 27 the Board noted that Nigerias economy has been. It stated this in a report published on Monday on the Article IV Consultation for.

Nigeria has to build these reserves that it has drawn from within 3¼ to 5 years. At the moment funding. As expected the International Monetary Fund IMF yesterday approved Nigerias application for 347183 billion to bridge shortfalls in the 2020 budget and respond to the COVID-19.

Nigeria as it is presently constituted and as it was intended from the start is a. These policy adjustments are conditions for IMF loans and serve to ensure that the country will be able to repay the IMF. With a low appetite for reforms and low ambition for economic growth all Nigeria could muster is a 15 billion World Bank loan.

Today at least IMF is so daring by running down Nigerias economy and dictating what conditions must be met to be granted any loan an indisputable leverage of any potential creditor. The 34 billion emergency funding for Nigeria on Tuesday by the International Monetary Fund IMF is a repayable loan approved to help the country cushion the impact of the coronavirus pandemic on. Backs fuel subsidy removal CBN reform policies International Monetary Fund IMF says despite the 35bn loan it gave Nigeria to cushion the effects of COVID-19 on the citizens and businesses in April 2020 socio-economic conditions of the people have worsened.

In a report published on Monday on the Article IV Consultation for 2020 which ended on January 27 the Board noted that Nigerias economy has been. The commitment fee can be as low as 015 and as high as 06.

Nigerian Naira Exchange Rate Usd To Ngn Aop News Forecasts

Nigerian Naira Exchange Rate Usd To Ngn Aop News Forecasts

Coronavirus Nigeria Seeks 7bn Loan From International Lenders

Coronavirus Nigeria Seeks 7bn Loan From International Lenders

Nigeria Obasanjo S Legacy 2007 Africa Research Bulletin Economic Financial And Technical Series Wiley Online Library

Nigeria Obasanjo S Legacy 2007 Africa Research Bulletin Economic Financial And Technical Series Wiley Online Library

Https Www Jstor Org Stable 43663278

Nigeria Nigeria Publication Of Financial Sector Assessment Program Documentation Technical Note On Strengthening Monetary And Liquidity Management

Nigeria Nigeria Publication Of Financial Sector Assessment Program Documentation Technical Note On Strengthening Monetary And Liquidity Management

Imf Loan To Nigeria Explained Nairametrics

Imf Loan To Nigeria Explained Nairametrics

Https Www Jstor Org Stable 4186385

Imf Approves 3 4 Billion Emergency Loan To Nigeria Africanews

Imf Approves 3 4 Billion Emergency Loan To Nigeria Africanews

Nigeria Staff Report For The 2016 Article Iv Consultation Nigeria 2016 Article Iv Consultation Press Release Staff Report And Statement By The Executive Director For Nigeria

Nigeria Staff Report For The 2016 Article Iv Consultation Nigeria 2016 Article Iv Consultation Press Release Staff Report And Statement By The Executive Director For Nigeria

Https Www Ifc Org Wps Wcm Connect 8558b682 13f1 4c97 9a94 94e3ead80dcf Covid 19 Rapid Assessment Nigeria Pdf Mod Ajperes Cvid Nkdu7az

Https Www Jstor Org Stable 24486891

Https Www Jstor Org Stable 24487214

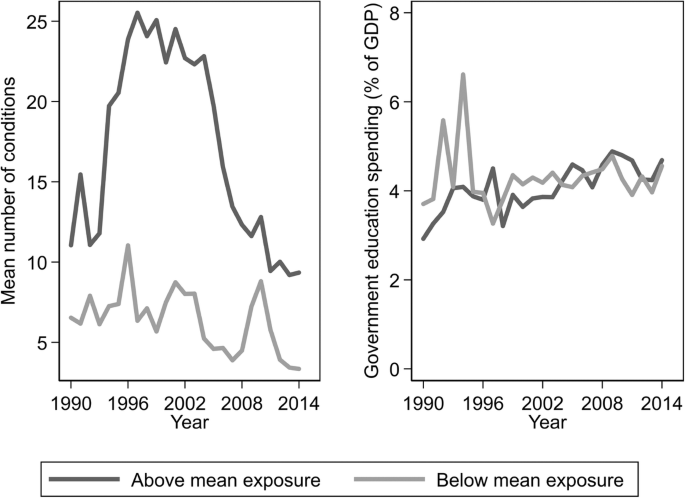

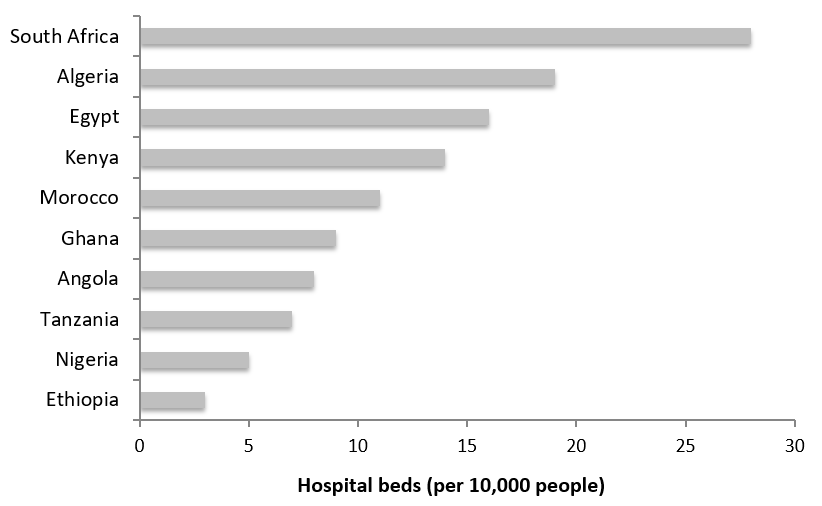

How Years Of Imf Prescriptions Have Hurt West African Health Systems

How Years Of Imf Prescriptions Have Hurt West African Health Systems

How To Evaluate The Effects Of Imf Conditionality Springerlink

How To Evaluate The Effects Of Imf Conditionality Springerlink

Imf Conditionalities Promote Unhealthy Conditions Psi

Imf Conditionalities Promote Unhealthy Conditions Psi

Dollar Liquidity Measures Leave Some Countries Out In The Cold Financial Times

Dollar Liquidity Measures Leave Some Countries Out In The Cold Financial Times

When A Failure To Diversify Meets Covid 19 Implications For Nigeria Igc

When A Failure To Diversify Meets Covid 19 Implications For Nigeria Igc