What Does A Downgrade In Credit Rating Mean

credit does downgrade whatA downgrade hurts the perception of the credit worthiness of the banks. Rating downgrade is a negative change in the credit rating of a debt security.

How Credit Rating Downgrade Of Companies Impacts Your Investments And What To Do Investing Credit Rating Investment Advice

How Credit Rating Downgrade Of Companies Impacts Your Investments And What To Do Investing Credit Rating Investment Advice

If the credit rating is low the power company will generally have to pay a high rate of interest to compensate for the higher risk that investors may not get their money back at all.

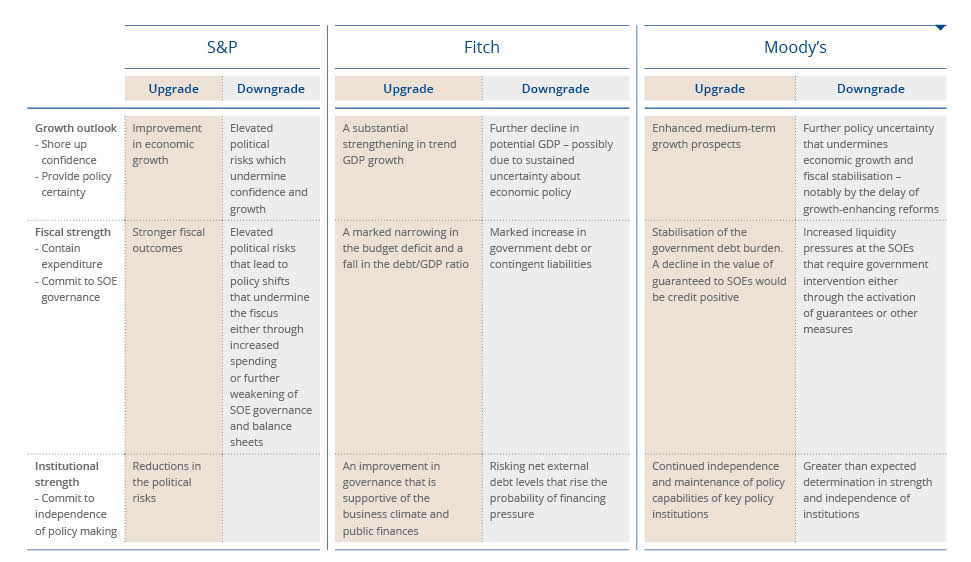

What does a downgrade in credit rating mean. From time to time one hears about countries companies and investing assets being downgraded to junk status. As ratings agency Moodys downgrades the credit rating of 12 UK financial firms we look at what these ratings mean and whether savers who were stung in 2007 by the Northern Rock collapse need. To denote the highest credit quality AAA symbol is used.

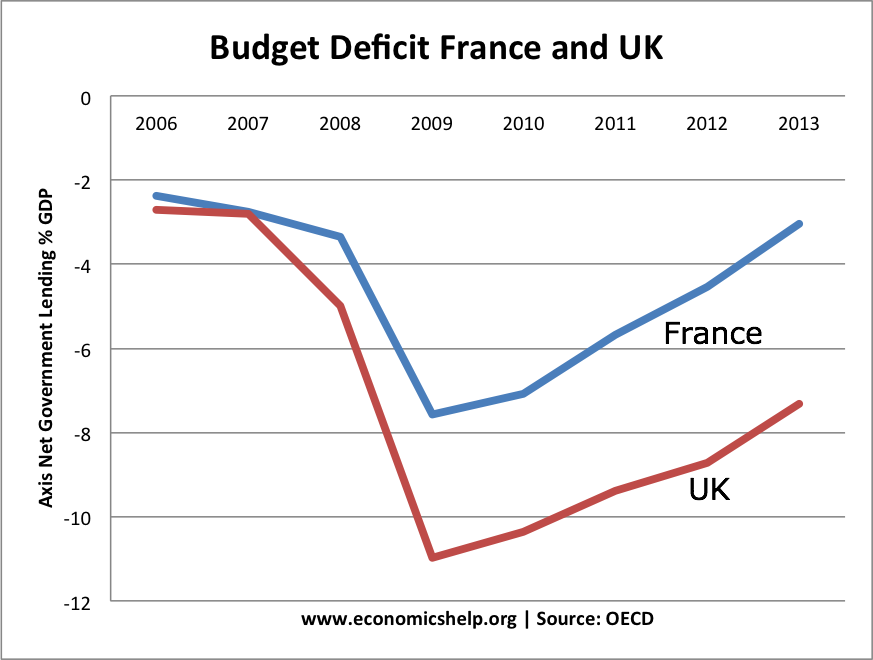

However the tag of junk that has now been hung around our countrys neck is still detrimental and it will impact on how we are seen by foreign investors and how strong our bargaining power is on the global stage. Credit ratings for countries are like credit ratings for people. Professor Philippe Burger Pro-Vice-Chancellor of Poverty Inequality and Economic Development at the University of the Free State in South Africa says that the downgrade means that medium- to long-run interests will now be higher as opposed to what it would have been in the absence of a downgrade.

When a rating agency raises a bonds rating this action is called an upgrade Similarly a lowered rating is called a downgrade Upgrades and downgrades can be key drivers of bond performance. A downgrade is a negative change in the rating of a security. The last is the lowest rating indicating likelihood of a default.

Credit ratings are issued by credit rating agencies private companies who sell their financial analysis to investors. The downgrade could translate into higher mortgage rates putting further pressure on an already weak real estate market. This is followed by symbols AA A BBB BB B C and D.

It indicates that the company may not be able to service its debt as per schedule or in some cases may even default. If a country is more likely to default on debt lenders charge a. One of the key reasons why companies face credit ratings downgrade is because of their deteriorating finances usually high debt levels.

Fitch Ratings stripped Canada of its AAA status amid a spike in emergency spending for Covid-19 making it the first top-rated country to be downgraded by the ratings agency during the pandemic. A poor credit score means you are considered a risky debt prospect. Credit rating has been downgraded the long-term economic impact remains uncertain.

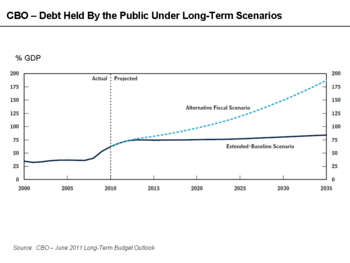

But what does this downgrade mean - and does it matter. In August 2011 the United States credit rating was downgraded by the credit rating agency Standard Poors SP from AAA to AA or down one level. That means low risk and a generally low interest rate.

If a credit downgrade puts you below investment grade you wont have that vehicle of the Financing Authority and it limits how much you can borrow elsewhere. Investors use sovereign credit ratings as a way to assess the riskiness of a. Because this is the first time in American history that the US.

This refers to the credit rating of an entity and its ability to meet future obligations. In essence a downgrade is just an assessment of our creditworthiness. A sovereign credit rating is an independent assessment of the creditworthiness of a country or sovereign entity.

That means they will have to pay relatively more to raise money from international investors he said. The same goes for interest rates on car loans credit cards etc. Performance Factors Leading to a Downgrade.

SP downgraded the US credit rating because of its debt and deficit burden. What is a credit rating. He explained that a.

This situation occurs when analysts feel that the future prospects for the security have weakened from the original recommendation. In this article we discuss credit rating agencies and what junk status means. The nation currently spends more money than it takes in and is having trouble paying back its loans.

Managing Ratings Downgrades Game Over Gravity Falls Opening Gravity Falls Fall Wallpaper

Managing Ratings Downgrades Game Over Gravity Falls Opening Gravity Falls Fall Wallpaper

Managing Ratings Downgrades Game Over Investment In India Investment Services Best Investment Apps

Managing Ratings Downgrades Game Over Investment In India Investment Services Best Investment Apps

Negative Outlook Moody S Downgrades Credit Rating Eye Witness News

Negative Outlook Moody S Downgrades Credit Rating Eye Witness News

Podcast 28 Why Credit Rating Agencies Are Irrelevant And Deserve A Downgrade Capitalmind Better Investing

Podcast 28 Why Credit Rating Agencies Are Irrelevant And Deserve A Downgrade Capitalmind Better Investing

Five Reasons Gravity Falls Is The Best Thing Ever Geek And Sundry Gravity Falls Characters Gravity Falls Cast Gravity Falls Wiki

Five Reasons Gravity Falls Is The Best Thing Ever Geek And Sundry Gravity Falls Characters Gravity Falls Cast Gravity Falls Wiki

Sa Credit Ratings Moody S Downgrades And Negative Outlook Discovery

Sa Credit Ratings Moody S Downgrades And Negative Outlook Discovery

Https Www Schroders Com En Sysglobalassets Digital Insights 2019 Pdfs Thought Leadership Downgrade Risks To Passive Credit Investing 2019 June The Downgrade Risks Facing Passive Ig Bondholders Pdf

Why Is Credit Rating Important For Bond And Sukuk Bix

Why Is Credit Rating Important For Bond And Sukuk Bix

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-534336840-5769eb9c3df78ca6e4977b35.jpg) Bond Upgrade And Downgrade Definition

Bond Upgrade And Downgrade Definition

Seal Datasheet Trading Derivative Seal Legaltech This Or That Questions

Seal Datasheet Trading Derivative Seal Legaltech This Or That Questions

Why Credit Ratings Matter And Why They Can T Be Ignored

Why Credit Ratings Matter And Why They Can T Be Ignored

Child S Guide To Credit Rating Downgrade A Warning Not To Be Ignored Daily Ft

Research Moody S Downgrades Ohio National S Ratings Outlook Remains Negative Moody National Life Insurance Life Insurance Corporation Credit Rating Agency

Research Moody S Downgrades Ohio National S Ratings Outlook Remains Negative Moody National Life Insurance Life Insurance Corporation Credit Rating Agency

United States Federal Government Credit Rating Downgrades Wikipedia

United States Federal Government Credit Rating Downgrades Wikipedia

Best Bank Nifty Tips Provider Yes Bank S Rating Downgrade Of Icra Care Yes Bank Bank Jobs Investment Advisor

Best Bank Nifty Tips Provider Yes Bank S Rating Downgrade Of Icra Care Yes Bank Bank Jobs Investment Advisor

Coronavirus And Junk Status Ratings Explained And Why There S Hope Explain

Coronavirus And Junk Status Ratings Explained And Why There S Hope Explain

Making Sense Of Provincial Debt Downgrades Macleans Ca

Making Sense Of Provincial Debt Downgrades Macleans Ca

What Determines Credit Rating For Countries Economics Help

What Determines Credit Rating For Countries Economics Help

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Bonds_Rated_Sep_2020-01-b7e5fc745626478bbb0eed1fb5016cac.jpg)

/GettyImages-592232681-c2b712f76a684519abdabf8d71187c33.jpg)